As of December 6, 2024, Babylon's Bitcoin staking protocol has achieved significant milestones, with 23,290 BTC staked and a total value locked (TVL) of $2.2 billion.

Following the completion of Phase-1 Cap-1 and Cap-2, Babylon is set to launch Cap-3 on December 10, 2024, at approximately 11 AM UTC. This phase will span 1,000 Bitcoin blocks, or about one week, during which all valid Bitcoin staking transactions will be accepted without a TVL cap.

Cap-1 vs Cap-2 vs Cap-3: What’s New

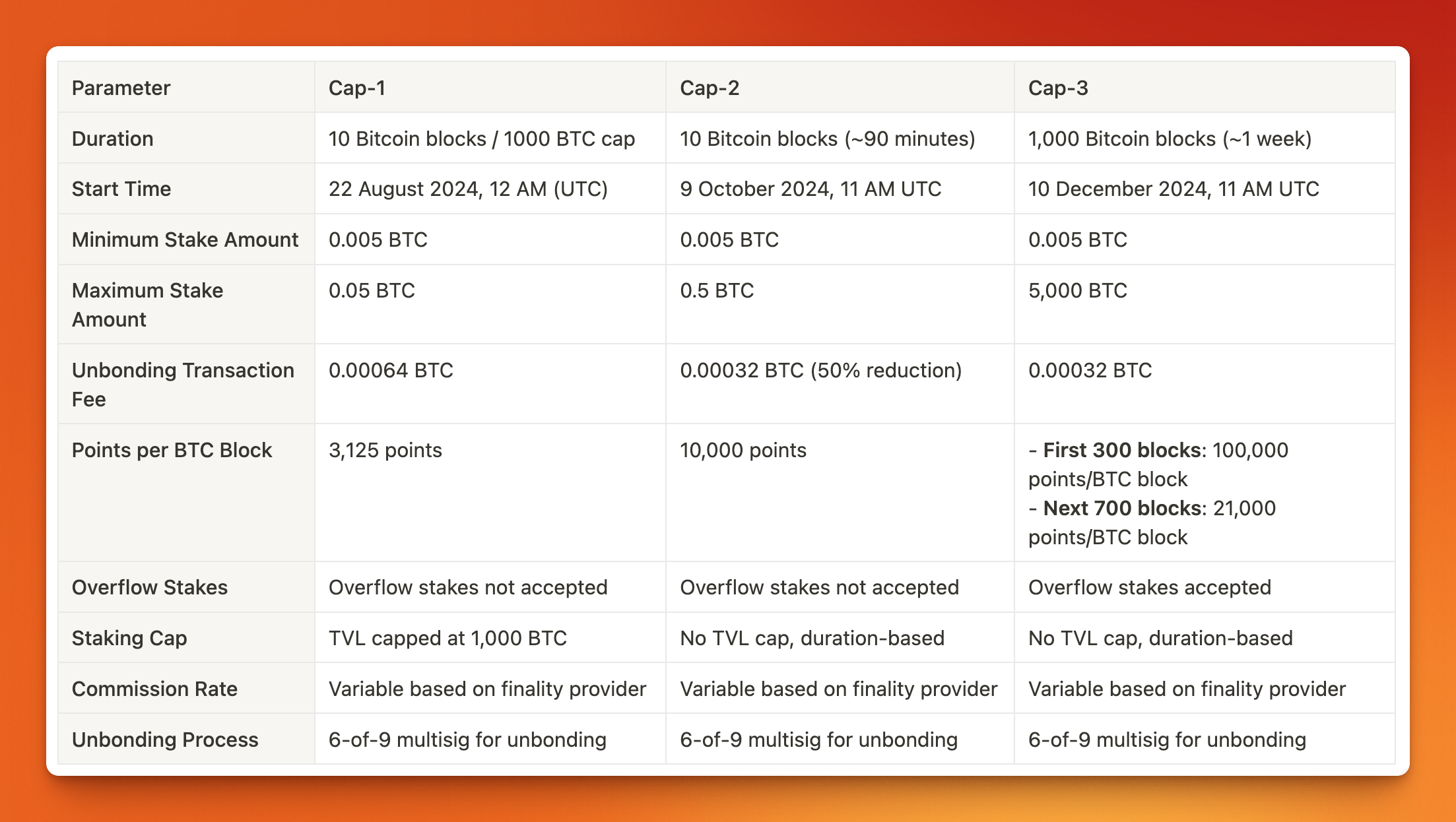

Table below highlights the key differences between Cap-1, Cap-2, and Cap-3, focusing on staking limits, duration, rewards, and key updates:

Cap-3 introduces updated staking parameters: the minimum stake per transaction remains at 0.005 BTC, while the maximum stake per transaction increases to 5,000 BTC. The unbonding transaction fee is set at 0.00032 BTC.

Additionally, the points system allocates 100,000 points per Bitcoin block for the first 300 blocks and 21,000 points per block for the remaining 700 blocks, distributed proportionally among all active stakes.

How to Join Babylon Staking Cap-3 ?

Cap-3 will officially begin on December 10, 2024, at 11 AM UTC. This phase will last for 1,000 BTC blocks, giving users around 1 week to stake their BTC.

To broaden participation, Babylon has partnered with platforms like Binance Earn, allowing users to stake BTC without on-chain operations. Collaborations with protocols such as OKX Wallet offer opportunities to earn multiple rewards through Liquid Staking Derivatives (LSD).

Stake via Binance Earn

Babylon has partnered with Binance to launch On-chain Yields, a feature that lets you participate in on-chain protocols and earn rewards directly through Binance.

- Start Date : December 9, 2024, at 06:00 UTC

- Total Cap: 1,000 BTC

- Subscription Range: 0.05 BTC to 5 BTC, operating on a first-come, first-served basis

Stake via OKX wallet

OKX has launched a campaign in partnership with Babylon, providing users the opportunity to stake BTC through the OKX Wallet. This initiative offers a user-friendly interface for staking and the potential to earn additional rewards.

Stake via LSD Protocols

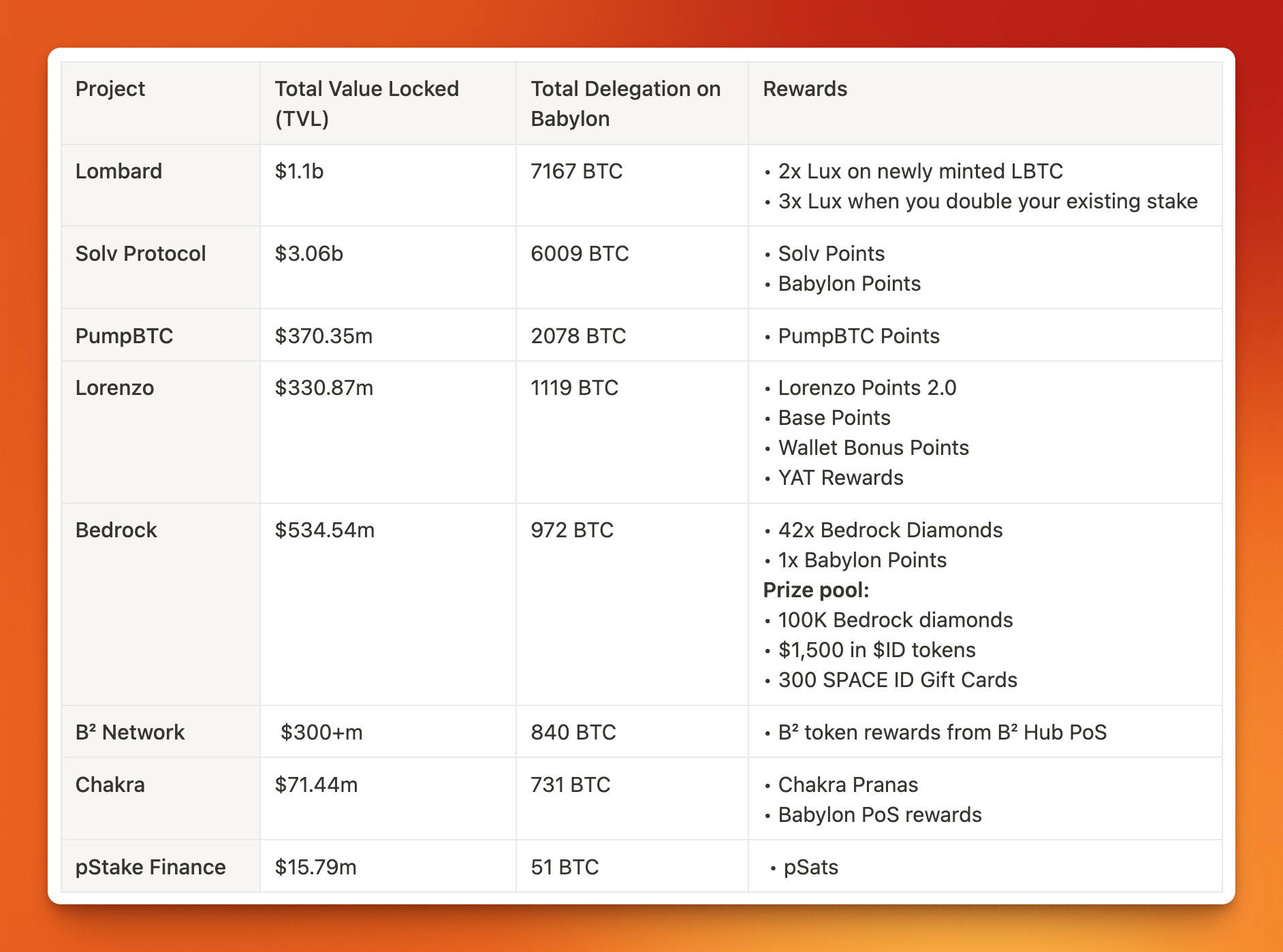

Several LSD protocols are participating in Cap-3, offering unique rewards and staking opportunities to BTC holders. These include Solv Protocol, Lombard, Lorenzo, and PumpBTC.

Each protocol provides distinct benefits and incentives for participants.

Lombard Finance is dedicated to unlocking Bitcoin's potential as a dynamic financial tool by connecting it to DeFi. Lombard enables the yield-bearing BTC to move cross-chain without fragmenting liquidity, paving the way to become the single largest catalyst for onboarding net new capital into DeFi. Its flagship product, LBTC—a yield-bearing, cross-chain, liquid Bitcoin backed 1:1 by BTC.

Solv Protocol–Pioneering a Leading Bitcoin Staking Platform. Unifying Bitcoin's Trillion Dollar Economy, Igniting BTCFi

PumpBTC serves as a Liquid Staking Solution for Babylon. PumpBTC aims to help BTC holders maximize yields through Babylon's staking - essentially rebuilding $WBTC/$BTCB/$FBTC with native yield.

Lorenzo Protocol is the Bitcoin liquidity layer, offering breakthrough Bitcoin financial instruments to advance BTC savings performance and a global network that provides Bitcoin financial products and yield-bearing tokens support with issuance, trading, and settlement.

Bedrock is a multiple asset liquid restaking protocol, backed by non-custodial solution designed in partnership with RockX. Bedrock utilizes its universal (uni) standard to unlock liquidity and maximum value in PoS tokens, such as ETH & IOTX, with existing liquid staking tokens called uniETH & uniIOTX.

B² Network is a modular Bitcoin Layer2 solution. It introduces B² Rollup, the first Bitcoin rollup based on verification commitment, and B² Hub, the first Bitcoin Data Availability (DA) layer that achieves finality on the Bitcoin network.

Chakra Chain is a Bitcoin restaking protocol based on ZK proofs. It utilizes STARKs to prove staking events on Bitcoin and verifies proofs on layer-2 chains.

pStake Finance is a liquid staking protocol that unlocks the liquidity of staked assets. Stakers of PoS tokens can now stake their assets while still maintaining their liquidity. When staking with pSTAKE, users earn staking rewards and also receive staked representative tokens (stkASSETs), which can be used in DeFi to generate additional yields on top of the staking rewards.

Conclusion: What Makes Cap-3 Stand Out

Babylon Staking Phase-1 Cap-3 is an incredible opportunity for BTC holders to earn substantial staking yields alongside platform rewards.

With an extended staking duration and significantly higher transaction limits, Cap-3 offers unparalleled flexibility and earning potential. The continuation of low unbonding fees further enhances its appeal, making it accessible to all types of Bitcoin holders.

Don’t wait—connect your OKX Web3 Wallet, stake your BTC, and unlock the full potential of staking rewards during Babylon Staking Cap-3!

About Satoshi Protocol

Satoshi Protocol is the first Bitcoin Finance Network powered by satUSD, a Bitcoin-backed stablecoin. Mint satUSD with BTC as collateral across the Bitcoin Mainnet and L1s/L2s.

Get started with Satoshi Protocol, follow us!

Website | Web APP | Twitter | Telegram | Discord | Docs | Blog