Over the past few months, we’ve observed a growing trend of users creatively leveraging Bitcoin 0% interest loans.

The ability to borrow satUSD stablecoins with 0% interest—by using BTC or LST as collateral—has quickly become a popular strategy.

This shift allows users to access liquidity without selling their Bitcoin, providing flexibility and opening the door to various investment opportunities.

How Does a 0% Interest Loan Work

Users deposit BTC or LST as collateral to mint satUSD stablecoins with a minimum collateralization ratio (MCR) of 110% for BTC and 120% for LST.

This process works like a Collateralized Debt Position (CDP), where the BTC is locked as collateral, enabling users to borrow satUSD without paying interest. A small minting fee (typically around 0.5%) applies during this process.

How Does Satoshi Protocol Loan Compare to Binance Loan

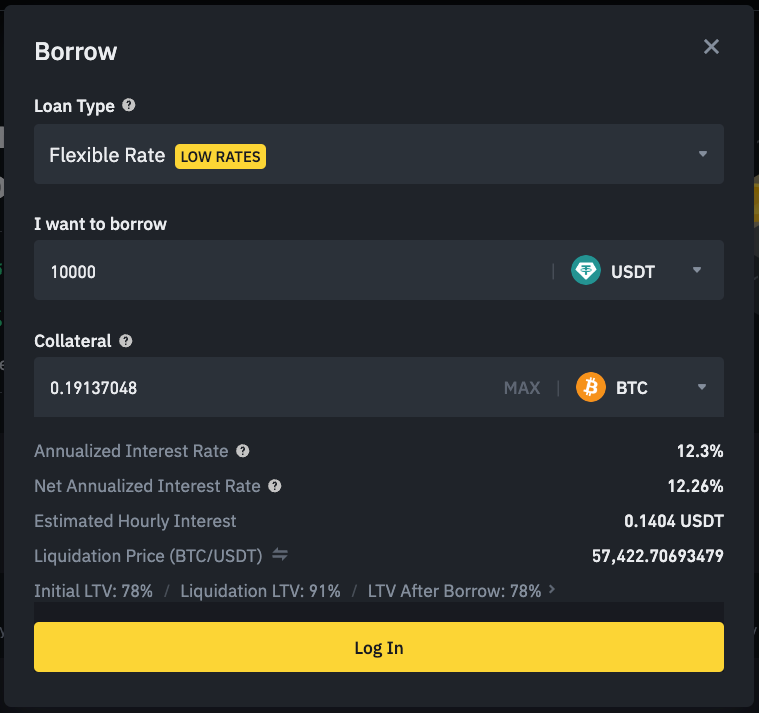

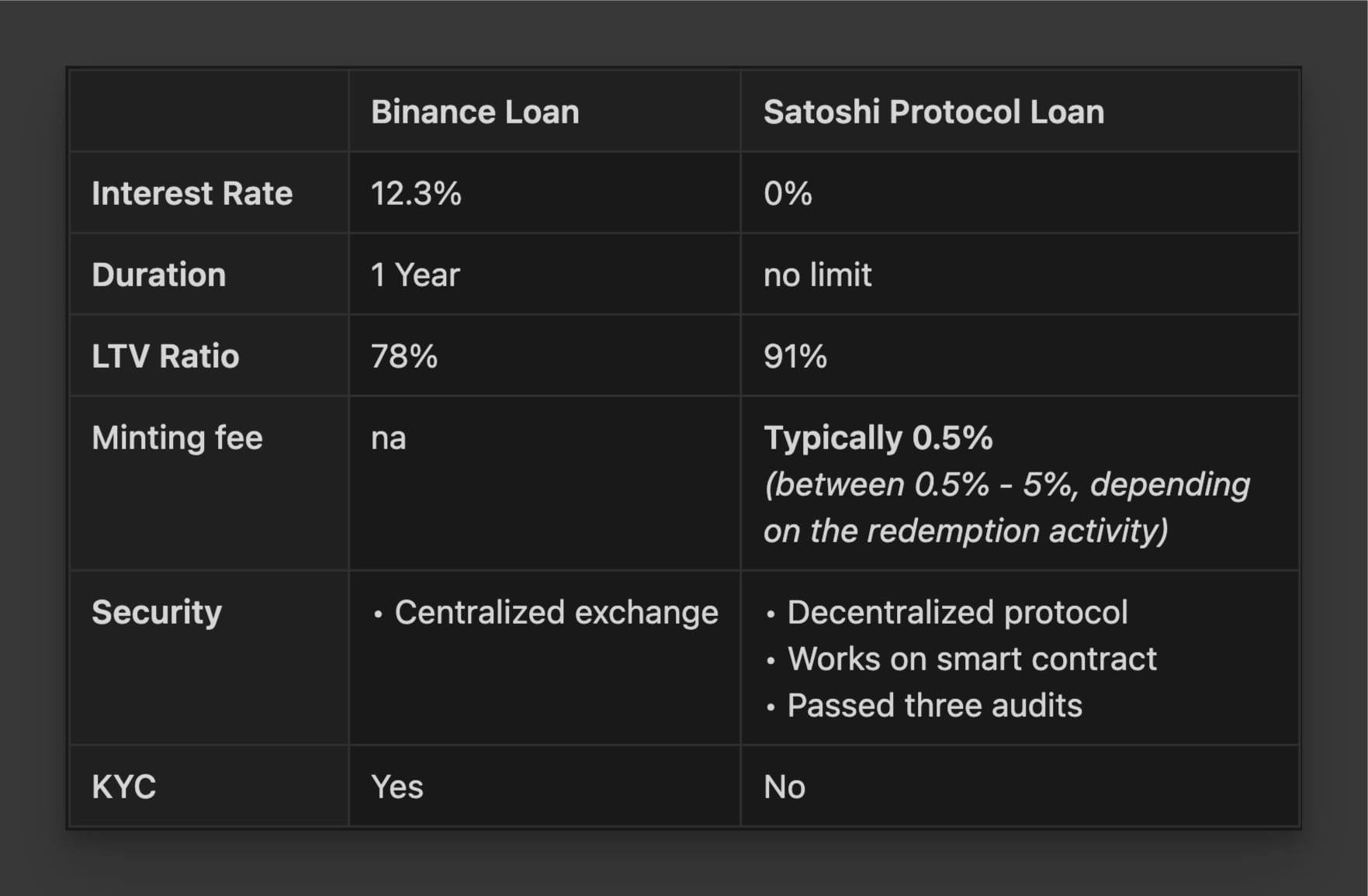

Binance charges 12.3% annualized interest rate to borrow USDT using BTC as collateral.

Here’s how Binance Loan compares to Satoshi Protocol’s Loan

Satoshi Protocol's '0% Interest Loan' offers clear advantages over Binance loan. It has no interest, no payback period, high LTV, and better privacy since no third party takes custody of your Bitcoin.

It's the ideal option for Bitcoin holders looking to unlock value without giving up ownership.

How Users Are Utilizing 0% Interest Loans

As users explore the benefits of 0% interest loans, several innovative strategies have emerged:

Leveraging BTC Growth

Many users purchase more BTC using interest-free loans, allowing them to amplify their holdings without extra costs.

Earning from Stability Pools

By depositing satUSD in stability pools, users benefit from discounted collateral during liquidations.

Staking and Restaking

Protocols like Solv enable users to stake and restake their Bitcoin, then use Liquid Staking Tokens (LST) to access 0% interest loans. This way, they earn staking rewards alongside their loans.

Lending

Users are actively lending their minted satUSD on platforms such as Segment Finance, allowing them to earn interest while still utilizing their collateral.

Providing Liquidity at DEXs

By supplying liquidity on decentralized exchanges (DEXs) such as Oku Trade and Sovryn, users earn trading fees.

Arbitrage Trading

Users are leveraging price differences across platforms to engage in arbitrage trading, taking advantage of the 0% interest loans to enhance their profitability.

Additional Rewards in the BTCFi Space

Beyond direct rewards like interest and trading fees, users also earn protocol incentives such as BOB Spice, Satoshi Points, and Solv Points by actively participating in the ecosystem.

In Summary

0% interest loans provide BTC holders with a unique way to access liquidity without selling their Bitcoins.

Users are pursuing innovative strategies such as purchasing more Bitcoin, earning rewards from stability pools, and providing liquidity on DEXs.

These loans offer clear advantages over traditional lending options and other borrowing alternatives in both the DeFi and CeFi spaces.