We’re excited to announce some enhancements to our stability pool, designed to bring you greater transparency and opportunities to earn rewards!

These updates allow you to:

- Visualize potential returns: Now you can view the estimated APR for depositing SAT into the stability pool.

- Earn Points through depositing: You’ll earn additional Points by depositing SAT into the stability pool.

What is Satoshi Protocol

Satoshi Protocol is a universal stablecoin protocol built specifically for Bitcoin. It empowers users to deposit their Bitcoin as collateral to borrow a stablecoin called SAT, on either Bitcoin Layer 1 or Layer 2.

Governed by the native token, OSHI, Satoshi Protocol has the potential to unlock trillions of dollars worth of Bitcoin, injecting liquidity into the burgeoning BTCFi space.

How does Satoshi Protocol work?

Satoshi Protocol allows you to use Bitcoin as collateral to mint a stablecoin called SAT. You’ll pay a fixed annual interest rate of 4.5% to borrow the SAT. These interest payments are then distributed to users who stake the OSHI token.

Over-collateralization

All SAT tokens are backed by real Bitcoin deposits. This is further strengthened by a system called over-collateralization. This means the value of your deposited Bitcoin will always be at least 110% of the amount of SAT you borrow, creating a buffer in case of Bitcoin price fluctuations.

Liquidation

However, if the value of your Bitcoin collateral falls below 110% of the SAT you borrow, a liquidation event will occur. Your Bitcoin collateral will be sold at a discount through the Stability Pool to repay your SAT debt. This discount incentivizes others to participate in this process, ensuring a smooth and efficient system for everyone involved.

What is the Stability Pool?

The Stability Pool is a core component of Satoshi Protocol, designed to ensure smooth liquidation and debt settlements. Users deposit SAT into stability pool. When liquidation happens, SP providers will acquire liquidated collateral at a discounted price.

- Depositing SAT: Users can deposit SAT into the Stability Pool, and become Stability Pool (SP) providers.

- Liquidation events: If the value of a user’s collateral dips below the Minimum Collateral Ratio (MCR) of 110%, the Stability Pool will provide the necessary liquidity for the liquidation. This process safeguards the protocol’s stability by preventing excessive debt.

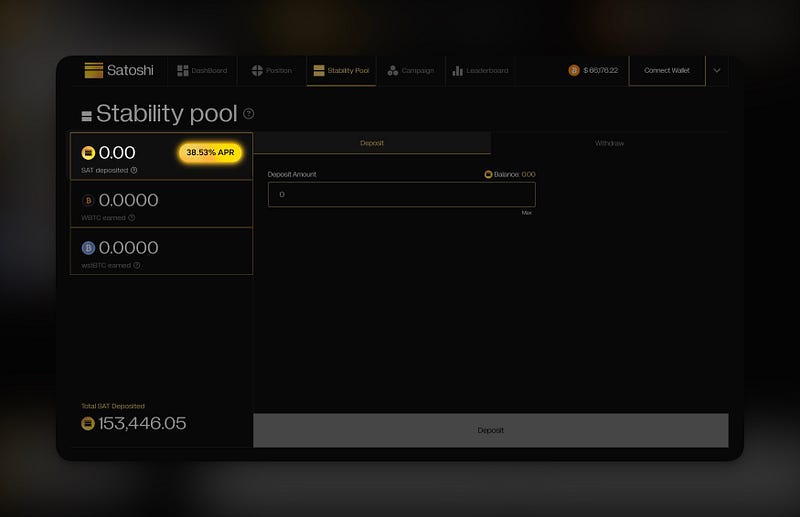

How Stability Pool’s APR is Calculated

Head over to the “Stability Pool” section to see the estimated APR (38.53% as of this example). This number represents the potential annual return you could earn by participating in the pool. The estimated APR is calculated based on the value of Bitcoin collateral liquidated over the past 7 days.

If the value of a user’s collateral dips below MCR (110%) due to BTC price fluctuations, a liquidation event will be triggered. The borrower’s Bitcoin will be sold at a discount to Stability Pool providers in order to repay the SAT loan. These discounts on liquidated Bitcoin contribute to the pool’s overall yield, which translates into the estimated APR.

By depositing your SAT into the Stability Pool and becoming a liquidity provider, you’re contributing to the health of the protocol. In return, you’ll have the opportunity to earn these discount Bitcoin rewards, reflected in the estimated APR.

APR formula :

APR = (Total Liquidated collateral Value - Total settlement SAT) / Total SAT deposit * (365 / 7)Earn Points by Depositing SAT into the Stability Pool

Now, users can earn Stability Pool Points by depositing SAT into the Stability Pool.

Here’s how you can benefit:

- By depositing SAT into the stability pool, you can earn “Stability Pool Points”

- Weekly Snapshots: Snapshots are taken every Saturday at 11 PM (GMT+8).

- For every 1 SAT deposited at the time of the snapshot, you earn 5 Stability Pool Points.

- Total Points = Position Points + Referral Points + Stability Pool Points

Here’s an example:

Alice deposited 1,000 SAT into the Stability Pool on Monday.

When the snapshot was taken on Saturday,

Alice got Stability Pool Points: 1,000 * 5= 5,000 Points

The next week, 200 SAT of Alice was exchanged for discount Bitcoin.

Alice had 800 SAT in the Stability Pool.

When the next snapshot was taken,

Alice got Stability Pool Points: 800 * 5= 4,000 Points

Alice's total Stability pool points: 5,000 + 4,000 = 9,000 Points Notes: The points won’t be counted if you withdraw your SAT before the snapshot.

For more information about Points, refer to Referral Program — Medium

How to Deposit SAT into Stability Pool

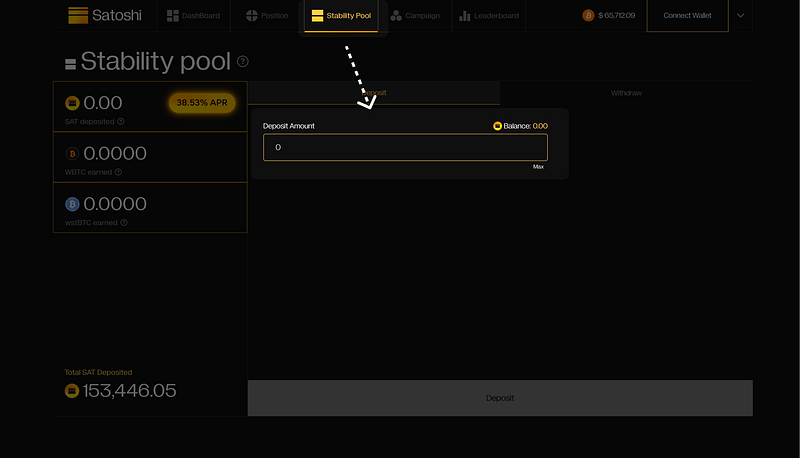

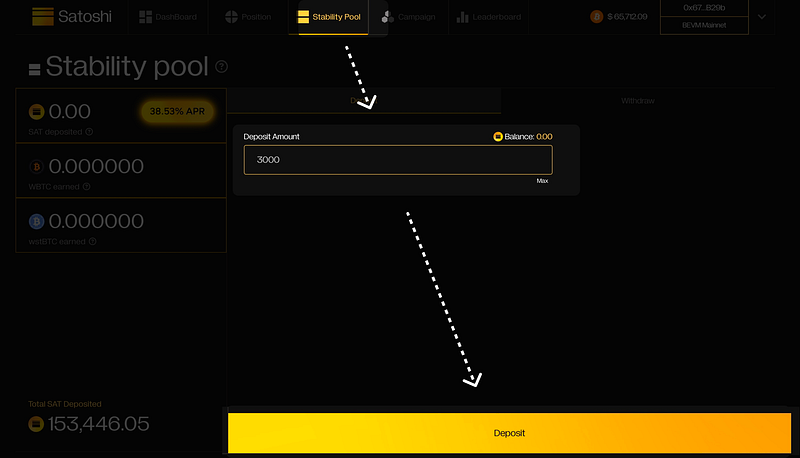

You can deposit SAT into the Stability Pool following these steps:

- Navigate to “Stability Pool” at Satoshi Protocol Stability Pool.

- Input the amount of SAT you wish to deposit.

- Click “Deposit.”

Conclusion

With the recent enhancements to the Stability Pool, you have more control over your earnings and the ability to contribute to a thriving DeFi ecosystem.

Head over to the Satoshi Protocol app today! Deposit SAT into the Stability Pool, start earning rewards, and experience a whole new way to unlock the full potential of your Bitcoin.

About Satoshi Protocol

Satoshi Protocol is a revolutionary universal stablecoin protocol backed by Bitcoin. It allows users to deposit BTC as collateral to borrow the stablecoin SAT, on either Layer 1 or Layer 2 of the Bitcoin network. This initiative facilitates the mobilization of trillions of dollars worth of Bitcoin within the BTCFi ecosystem.

Website | Web APP | Twitter | Telegram | Discord | Docs | Blog