The first Satoshi Protocol AMA session concluded successfully on the 13th of March, featuring our co-founder Gimmy who provided the community with a introduction to Satoshi, the team’s background, and explained protocol mechanism.

Date : 9pm 13th March ( UTC+8 )

This recap aims to give an overview of what Satoshi Protocol is, who we are as a team, and why we have chosen to build a Collateralized Debt Position (CDP) on the BEVM.

You can read all chat history in #text-AMA channel. For those looking to delve deeper into the specifics, we encourage you to consult our documentation for detailed insights.

Introduction

Hello @everyone, welcome to the first AMA of Satoshi Protocol.

The AMA will start shortly and will be on our discord 💬|text-ama channel.

Users interested in Satoshi Protocol can check the history on the 💬|text-ama after the event to better understand the project information and updates.

Let me introduce myself first

Hello, this is Satoshi . Moderator of Satoshi Community.

I’ll be asking questions to the co-founder of Satoshi Protocol about the project, development plans and tokenomics.

Ok, let’s have a warm welcome for Gimmy , the Co-Founder of Satoshi Protocol.

He is currently responsible for the planning of the project’s mechanism, as well as external financing and communication.

Gimmy : Hey @everyone, good to be here. Excited to have you guys join this journey with us!

Q1. What Is the Satoshi Protocol ?

In a very simple terms, Satoshi Protocol is a protocol that uses Bitcoin as collateral to mint stablecoin SAT, which pegged to the US dollar. The core of this type of over-collateralized stablecoin lies in three key benefits :

- It allows for the release of liquidity while holding a Bitcoin position.

- You need liquidity but do not want to risk triggering a taxable event.

- It can provide a natural, decentralized leverage.

Q2. What is Satoshi Protocol doing, and what are its features could make it stand out in many BTCFi projects

Gimmy : So, Satoshi Protocol is THE first CDP (Collateralized Debt Position) protocol within the BEVM ecosystem, aiming to provide liquidity for BTC and expand the application landscape of BTCFi through the stablecoin.

Users can deposit BTC as collateral and borrow SAT, which is pegged to 1 USD.

The features of CDP, as mentioned above, mainly include: obtaining liquidity while maintaining exposure, avoiding triggering taxable events, and obtaining decentralized leverage.

It is obvious that SAT will play a significant role in the future BTC ecosystem.

With the arrival of BTCFi, the demand for stablecoin based on BTC is also urgent. Satoshi Protocol is willing to make early practices for this vision.

Q3. Why choose BEVM and what are the advantages over other Bitcoin Layer2 solutions ?

Gimmy : This is a great question!

BEVM is an EVM-compatible chain that supports development in Solidity, significantly lowering the development threshold.

Plus, it allows for the migration of existing dApp and development resources from the Ethereum ecosystem.

Besides being secured by Bitcoin network, its compatibility with the Ethereum ecosystem gives us more opportunities to build a complete product matrix and usage scenarios. After all, the goal of stablecoin is to have USE CASES for utilizing them.

Additionally, with strong support and commitment from the BEVM Foundation, such as in product design, auditing, fundraising, and collaboration between protocols, we got enough room to build 😎

Q4. Now, we understand that CDP is the core concept of the Satoshi protocol, but for those who are not familiar with DeFi, could you explain more about what CDP is and how it works ?

Gimmy : When discussing stablecoin, they are typically classified into three types: centralized stablecoin, over-collateralized stablecoin, and algorithmic stablecoin.

Examples of centralized stablecoin include USDT and USDC, over-collateralized stablecoin include DAI and LUSD, and algorithmic stablecoin include early projects like AMPL and BAC.

Over-collateralized stablecoin often appear in the form of CDPs (collateralized debt positions), with MakerDAO being the most representative, and it is also the foundation of the entire Ethereum DeFi ecosystem.

The mechanism is similar in that it requires users to use crypto assets as collateral to mint/lend stablecoin. When the debt of the stablecoin is paid off, the original collateral can be retrieved.

Overall, we think CDP model is a proven and mature mechanism to maximize the liquidity and utility of tokens.

Q5. Please give more background about who is behind the Satoshi protocol, how many people so far, and what the background is.

Currently, there are five core members with diverse backgrounds from different fields, including a developer, an auditor, a seasoned DeFi researcher, a partner with exchange experience, and a FRM risk analyst.

They are also supported by the executive team, such as legal, accounting, and finance staff.

We also appreciate early contributors helping us manage the community.

and Special thanks to RK, he was active and helped many people to participant in Satoshi Protocol!

Q6. What role will SAT play within the BTCFi ecosystem, particularly in terms of its use as collateral, its function in DeFi activities, and its impact on bridging BTCFi with the wider crypto market ?

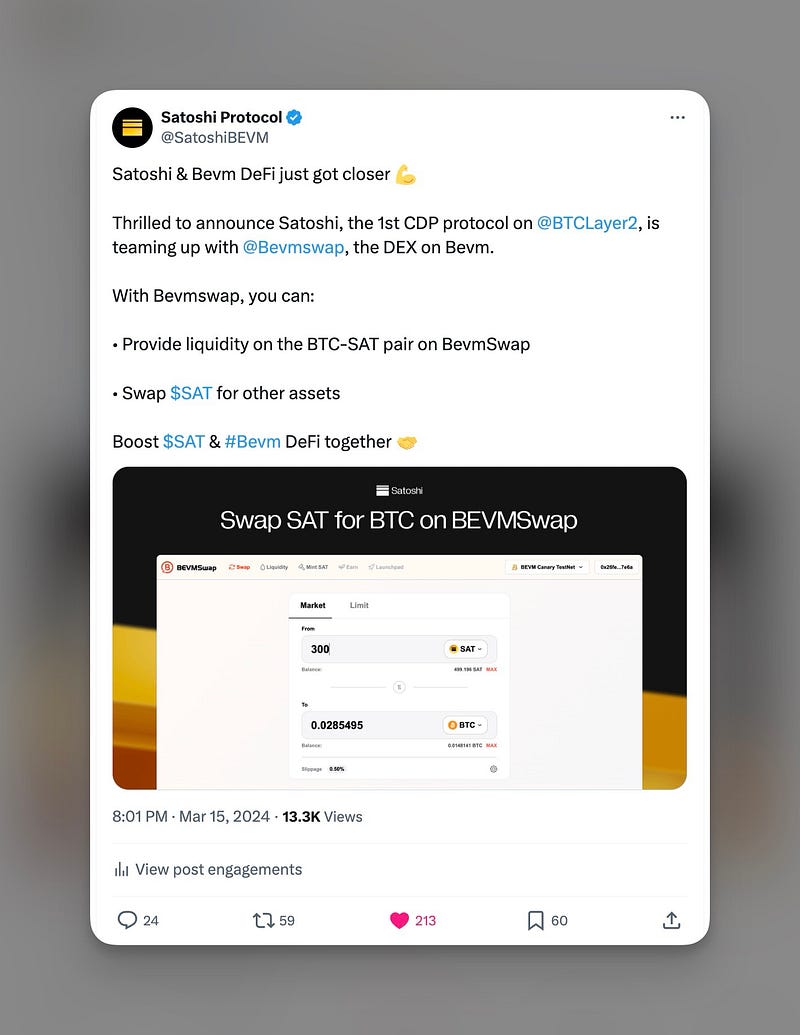

Users deposit BTC as collateral on Satoshi Protocol and borrow SAT to use on DEX for swapping and lending agreements.

The vision is for SAT to be not just a unit of value measurement in the BTCFi ecosystem, but, due to its ERC20 format, a unit of value measurement for the entire crypto field.

This also means that it will not only be used in the BTC ecosystem but will also be able to access all mainstream markets for trading and circulation in the future!

IMO, the most attractive aspect of DeFi is its composability, and the role that SAT, or the Satoshi Protocol, will play in what we expect to happen with BTCFi is very clear and focused: SAT will play the role of a fundamental layer, a solid cornerstone on which other DeFi protocols can build.

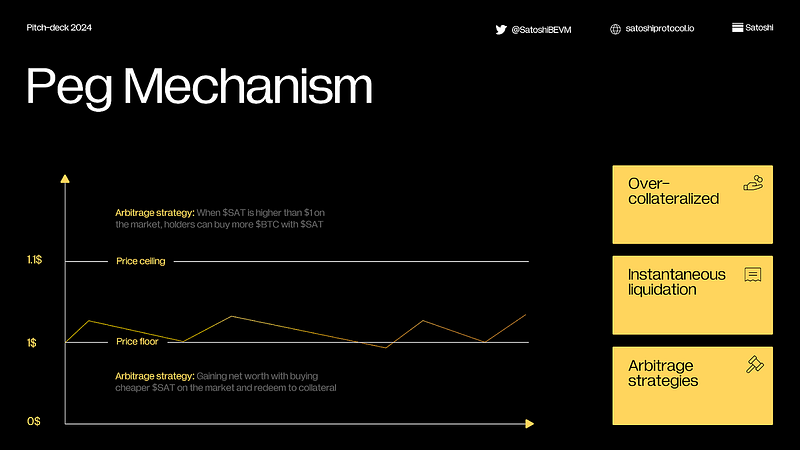

Q7. Could you explain more about how Satoshi protocol ensures SAT can peg to $1 USD most of the time ?

you can refer to our docs for the details.

But in short :

- when SAT < $1, arbitrageurs buy SAT and redeem for $1 USD worth of BTC. (and ofc can sell it right away to pocket the profit)

- when SAT > $1.1, arbitrageurs sell premium SAT by borrowing/minting SAT directly!

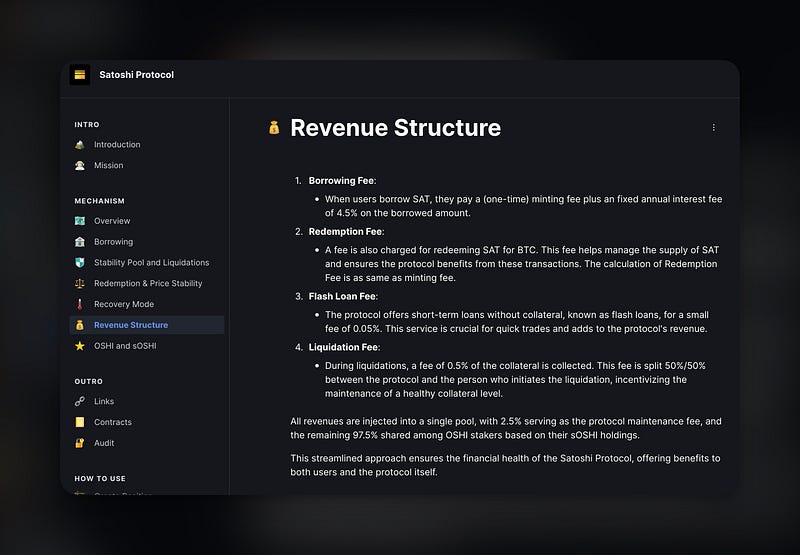

Q8. How does the Satoshi Protocol generate revenue, and how is this revenue distributed among the team and protocol for long-term sustainability and safety ?

Gimmy : Oh yeap, this “real yield” or “real rev” does matters!

Currently, the protocol’s main revenue comes from the following five sources :

- One-time fee (minting fee) for Create Position

- Borrowing Interest Fee

- Redemption Fee

- Flash Loan Fee

- Liquidation Fee

It’s quite diverse! And again for the details of each income, please refer to the our docs!

As this income distribution: all revenues are injected into a single pool, with 2.5% serving as the protocol maintenance fee, and the remaining 97.5% shared among OSHI stakers based on their sOSHI holdings.

Q9. Could you outline the strategic steps SAT intends to take for expanding its scenarios across EVM-compatible chains and dApps, including potential collaborations and upcoming updates ?

Since SAT is an ERC-20 formatted token, its application scenarios are extremely wide-ranging, theoretically reaching all EVM-compatible chains or dApps.

Our strategy can be divided into three clear steps:

- Integrate all Dapps on BEVM

- Expand to all Bitcoin L2s that support the ERC-20 forma

- Re-enter the EVM market.

Because the Satoshi Protocol is a fundamental type of protocol, any dApp is welcome to contact us!

Q10. Is the Satoshi Protocol secure? Has it undergone an audit?

DeFi and cryptocurrencies are both high-risk investments, especially when it comes to on-chain operations, so users are advised to be cautious when clicking on any link!

The code for Satoshi has been audited by two reputable auditing companies, and the results will be published soon!

Q11. Could you give a brief intro about SAT and OHSI ? but cover more about the scenario of OSHI.

SAT is the stablecoin on the Satoshi Protocol, while OSHI is the utility token within the Satoshi Protocol.

As mentioned above, protocol income is shared among OSHI stakers based on their sOSHI.

Q12. Can you explain in detail the distribution and function of OSHI?

OSHI will be mainly distributed via mining mechanisms.

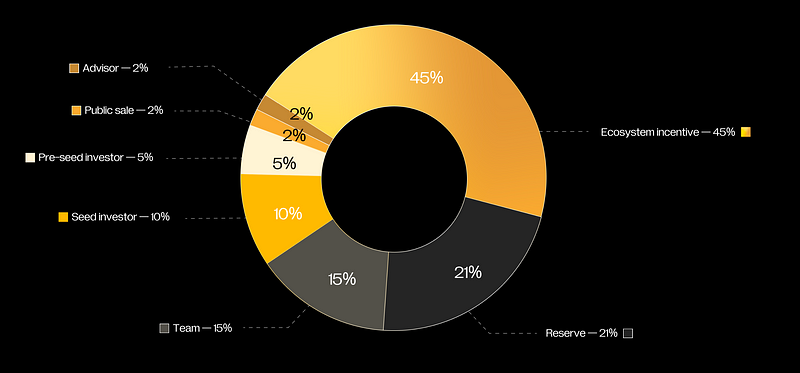

As you can see in the figure above, ecosystem incentive distribution accounts for 45% of the total tokens, all of this 45% would distributed through mining mechanisms.

The mining mechanism of OSHI consider the three different import factors of long-term stability and utility of the protocol, including Creating a Position, Depositing SAT, Utilize SAT. you can find this in detail in our docs.

But again, the method and allocation design is trying to be as fair as possible to the community and the long-term success of the protocol.

Q13. How to participate in Satoshi protocol ? What are the benefits

Currently, we are operating on the testnet (after all, BEVM is still on the testnet, and we cannot go live earlier than them lol)

You can already have the full experience on the testnet, such as creating positions and providing liquidity for the Stability Pool, and so on.

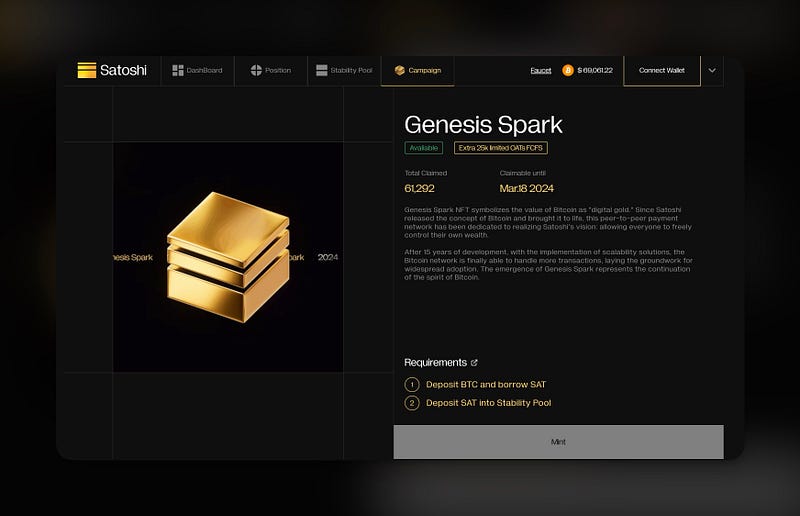

Also, there are some ongoing campaigns.

One is the Genesis Spark NFT minting campaign: simply by creating a position and depositing SAT into the Stability Pool.

The other is the Satoshi Pioneer OAT claim on Galxe, details can be found on our Medium or directly on the Galxe page. Although the process is a bit complicated and the quantity is limited, but, IYKYK 😎

Q14. What are the future development plans ?

We are already preparing to do the mainnet launch on BEVM, but the details are still being discussed closely with the BEVM team.

We are also collaborating with many protocols, and you can find the latest information on our Twitter.

Stay tuned !

Q&A with Community

For all questions related to the airdrop, all I can say is that airdrops are one of the most common methods to attract users on board in the crypto world.

As a community-driven protocol, the Satoshi Protocol naturally adopts relevant and reasonable approaches to provide the related utility/interest to the community!

Regarding the fundraising-related question:

We are about to close the current round, and will reveal the related information once everything is settled.

Regarding the roadmap-related question: As mentioned previously, we will start with the integration of BEVM, then move on to Bitcoin L2, and finally, we will focus on the EVM ecosystem.

However, Bitcoin L2 is currently in a state with many unknowns. We will provide more detailed information when it is reasonable to do so! Stay tuned!

Conculsion

The first Satoshi Protocol AMA session, featuring co-founder Gimmy, provided a comprehensive overview of the protocol, including its foundation, mechanism, and future plans.

Key topics covered were the protocol’s use of BTC as collateral, the choice of BEVM for its development, and the features that distinguish Satoshi Protocol within the BTCFi ecosystem.

To engage further with the Satoshi Protocol, you can explore satoshi protocol on the testnet, participate in ongoing campaigns such as the Genesis Spark NFT minting, and stay updated on future developments through our official channels.

For detailed insights into the protocol’s mechanism, revenue model, security measures, and the strategic vision for expansion, we’d suggest read the official document and follow @SatoshiBEVM updates on twitter and community.

Website | Web APP | Twitter | Telegram | Discord | Docs | Blog