We're thrilled to announce that Satoshi Protocol has officially launched on the Hemi mainnet, backed by Binance labs.

This integration is a major step forward in realizing our vision of creating a Bitcoin Finance Network, powered by satUSD—a Bitcoin-backed stablecoin.

What is Hemi

The Hemi is a modular protocol that integrates Bitcoin and Ethereum in a way that amplifies and extends the core capabilities of the two leading blockchain networks.

Hemi represents a novel perspective on how to address blockchain interoperability and scaling by approaching Bitcoin and Ethereum as components of a single supernetwork versus disparate ecosystems.

How Does This Integration Benefit Satoshi Protocol Users?

The integration with Hemi’s modular architecture unlocks a new level of efficiency and flexibility for Satoshi Protocol. It streamlines the minting and management of satUSD, enabling faster and more cost-effective cross-chain transactions. Users can easily maintain minimum collateral ratios, making the system both user-friendly and resilient.

Hemi’s innovative Proof-of-Proof (PoP) consensus model enhances the protocol’s stability. By combining Bitcoin’s unparalleled security with Ethereum’s versatility, this partnership strengthens satUSD’s Stability Pool, improves liquidity options, and enhances the protocol’s ability to navigate market fluctuations.

Getting Started with Satoshi Protocol on Hemi

Bridge Your Assets to Hemi

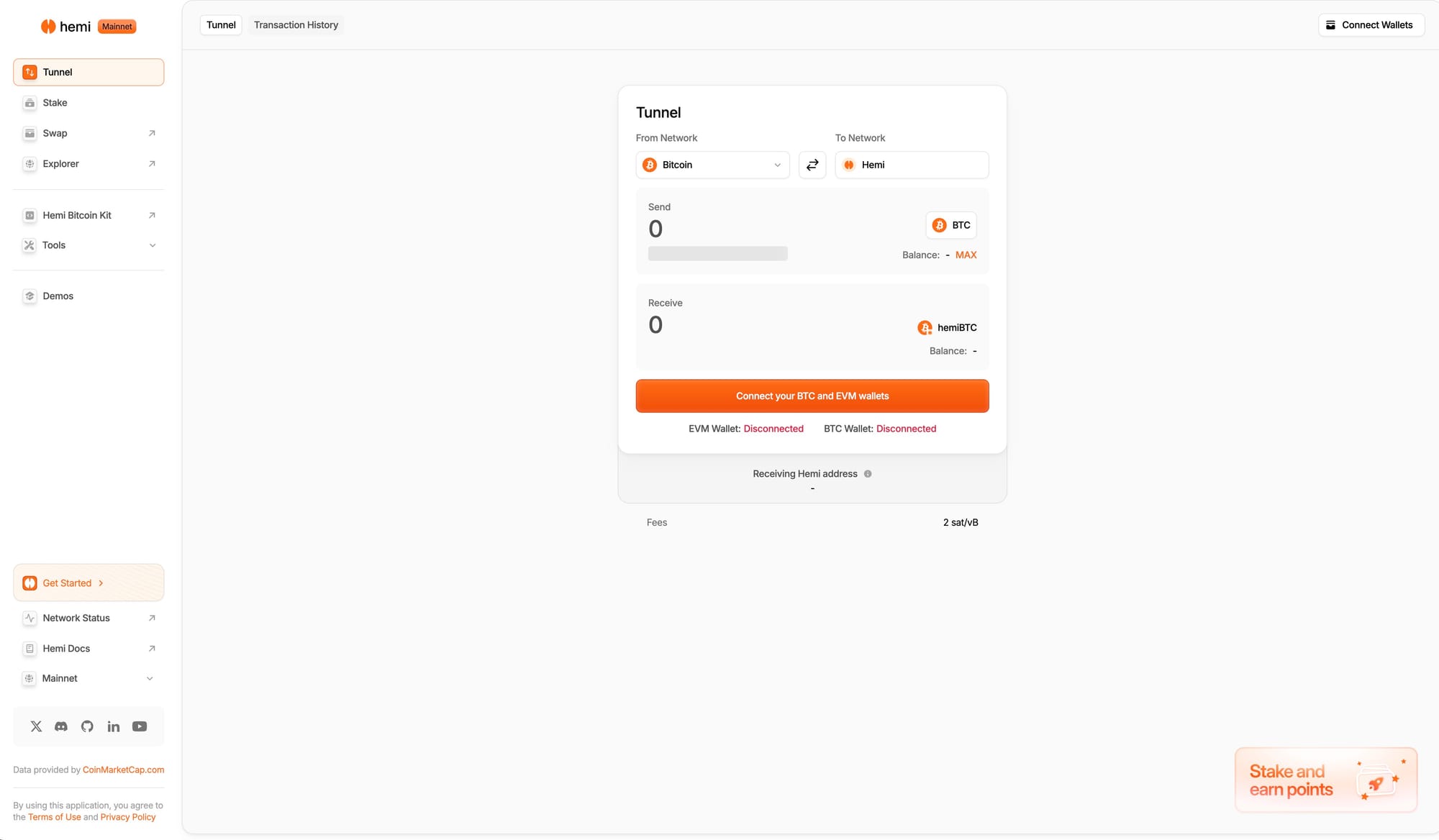

- Bridge ETH from Ethereum to Hemi via Hemi Tunnel ( GAS fee )

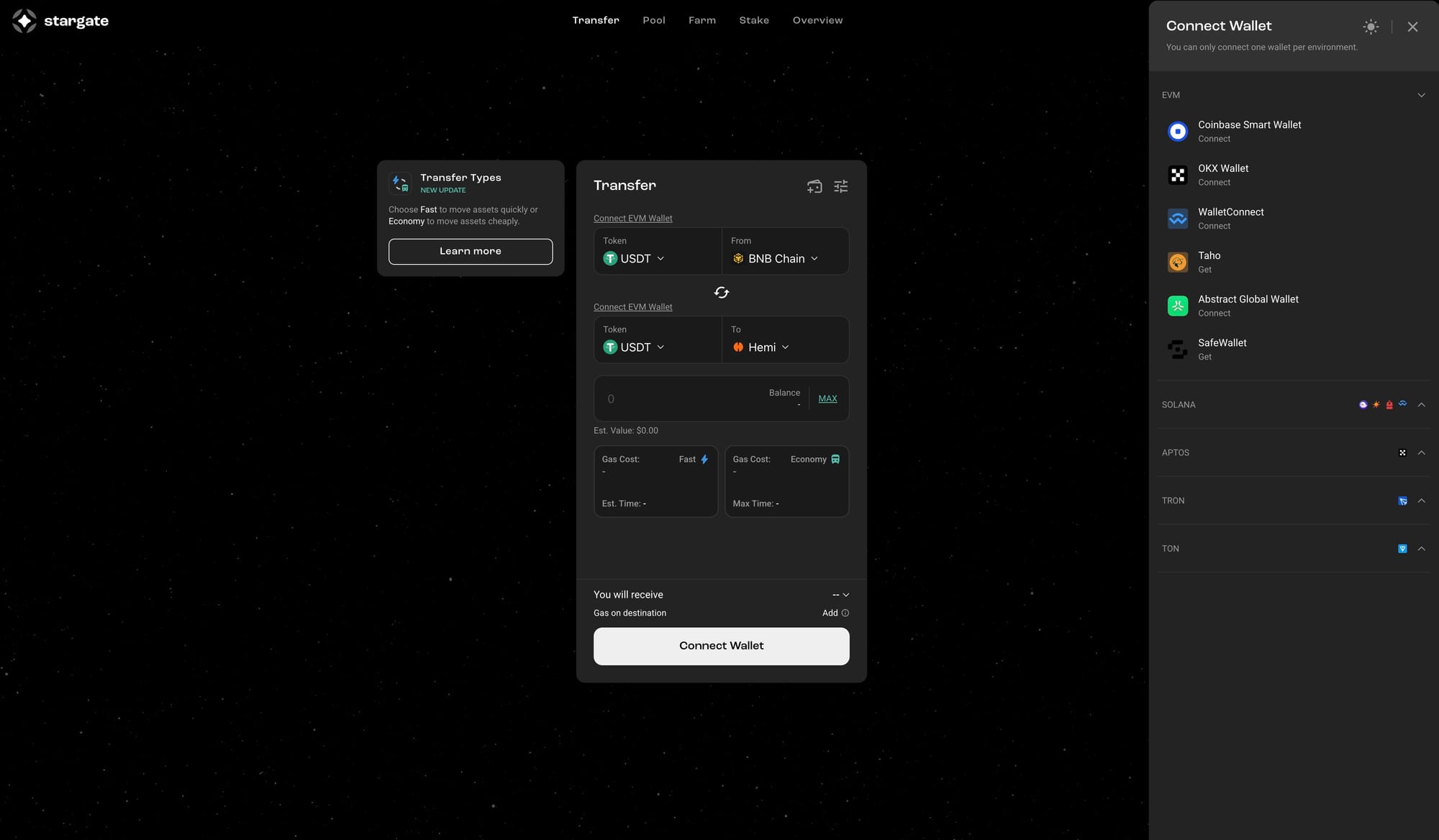

- Transfer USDT from BNB to Hemi via Stargate

Obtain BTC-Backed Assets

- Deposit BTC from BTC miannet to Hemi

- Swap USDT for HemiBTC on Sushiswap

Mint satUSD on Hemi

- Visit the Satoshi Protocol

- Navigate to Mint Page

- Select your collateral : HemiBTC

- Choose your desired satUSD minting amount

- Monitor your position https://app.satoshiprotocol.org/position

How to mint satUSD on Hemi

Consider swapping your USDT for satUSD at a 1:1 ratio. Once you mint satUSD, you can use to purchase BTC or USDT.

This process gives you the flexibility to leverage your assets and optimize your yield farming strategies on Hemi.

What You Can Do with satUSD on Hemi

- Mint satUSD with LSD Tokens on Hemi

- Deposit satUSD into Stability Pool to earn liquidated collateral

- Provide Liquidity on Sushi, Oku, & Curve: Supply satUSD liquidity and earn trading fees.

- Swap on Hemi Dex, Sushi, Oku, & Curve: Seamlessly trade assets within the ecosystem.

Collateral Requirements on Hemi

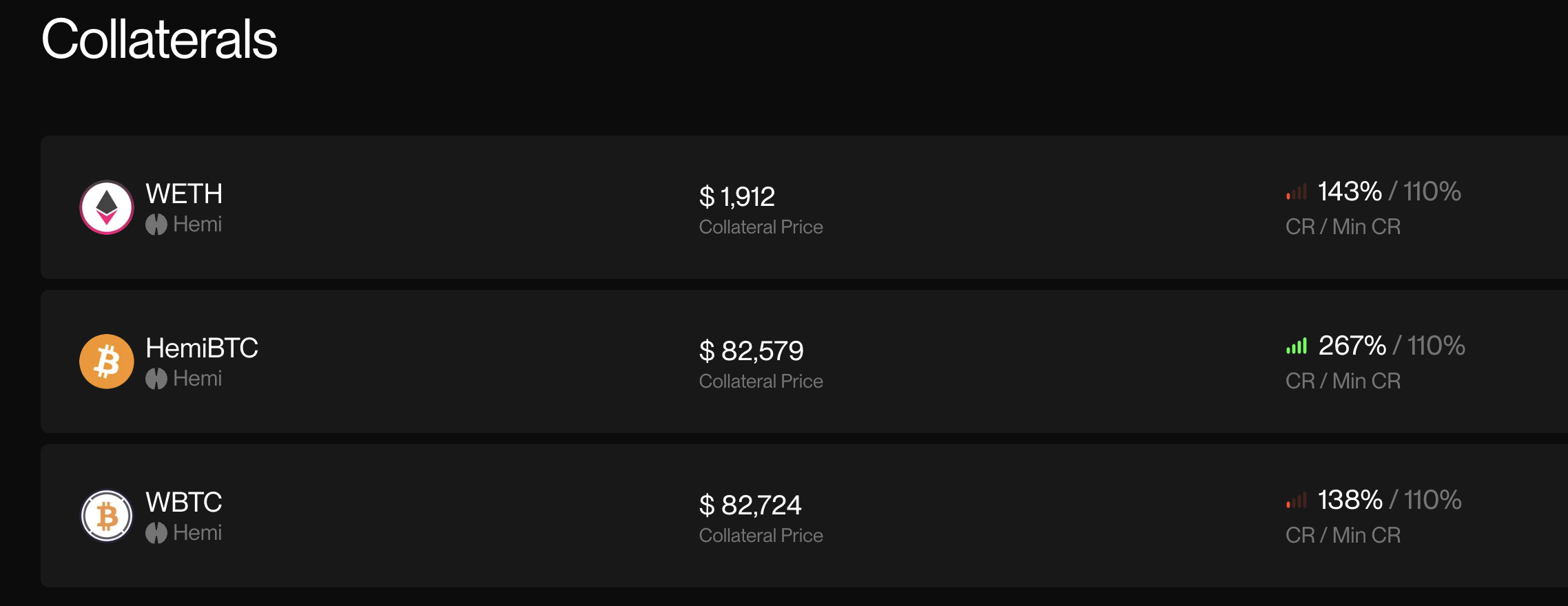

When using HemiBTC or wBTC as collateral on Satoshi Protocol, maintaining the required collateral ratio is essential to avoid liquidation:

- wBTC (Hemi): Minimum Collateral Ratio (MCR) is 110%

- HemiBTC: Minimum Collateral Ratio (MCR) is 110%

⚠️ Falling below these thresholds will trigger liquidation, resulting in the loss of collateral. Monitor your position carefully, especially in volatile markets

About Hemi

The Hemi is a modular Layer-2 protocol for superior scaling, security, and interoperability, powered by Bitcoin and Ethereum.

Website | Twitter | Telegram | Discord | Docs | Blog

About Satoshi Protocol

Satoshi Protocol is the first AI-driven Bitcoin finance network, designed to unlock Bitcoin’s liquidity and expand its financial utility. By integrating AI-powered omni-chain interoperability, liquidity governance, and risk management, Satoshi Protocol connects BTC liquidity to the broader ecosystem.

Website | Web APP | Twitter | Telegram | Discord | Docs | Blog