LSDFi Lands on BEVM!

We’re excited to announce a strategic partnership between Satoshi Protocol and Bido to accept their LST wstBTC as collateral for borrowing SAT!

Bido is a leading Bitcoin liquidity staking protocol on BEVM. This collaboration marks a significant step forward in enhancing the Bitcoin DeFi (BTCFi) ecosystem by integrating staking solutions with our CDP offerings.

What is Satoshi Protocol?

Satoshi Protocol is the first Collateralized Debt Position (CDP) protocol built on BEVM, aiming at providing liquidity for BTC through the SAT dollar stablecoin, expanding the scenarios of BTCFi.

This move unlocks trillion-dollar liquidity within the Bitcoin ecosystem, offering users a way to maintain Bitcoin holdings while gaining liquidity.

To learn more about Satoshi Protocol, visit: Satoshi Protocol: The First CDP on BEVM, Unleash BTCFi for everyone

What is Bido Finance?

Bido Finance is a liquid staking protocol for Bitcoin on the BEVM network, inspired by Lido on Ethereum. It allows users to stake their BTC and receive stBTC tokens in return. These stBTC tokens represent the staked BTC and can be seamlessly integrated into various DeFi applications.

Bido marked its official arrival on the BEVM network on March 31st, 2024. Users staking their Bitcoin on Bido were once rewarded with a remarkable 534% APR, setting a new standard for Bitcoin staking returns

What are stBTC and wstBTC?

stBTC (Staked BTC)

stBTC is a transferable rebasing utility token representing a share of the total BTC staked through the protocol, which consists of user deposits and staking rewards. Because stBTC rebases daily, it communicates the position of the share daily.

stBTC maintains a 1:1 peg to the underlying BTC, allowing users to easily redeem their staked BTC at any time. By staking BTC through Bido, users can earn rewards in the form of additional stBTC tokens, representing their share of the BEVM network’s gas revenue. Now, almost 50% of the gas revenue is distributed to Bido stakers.

wstBTC (Wrapped stBTC)

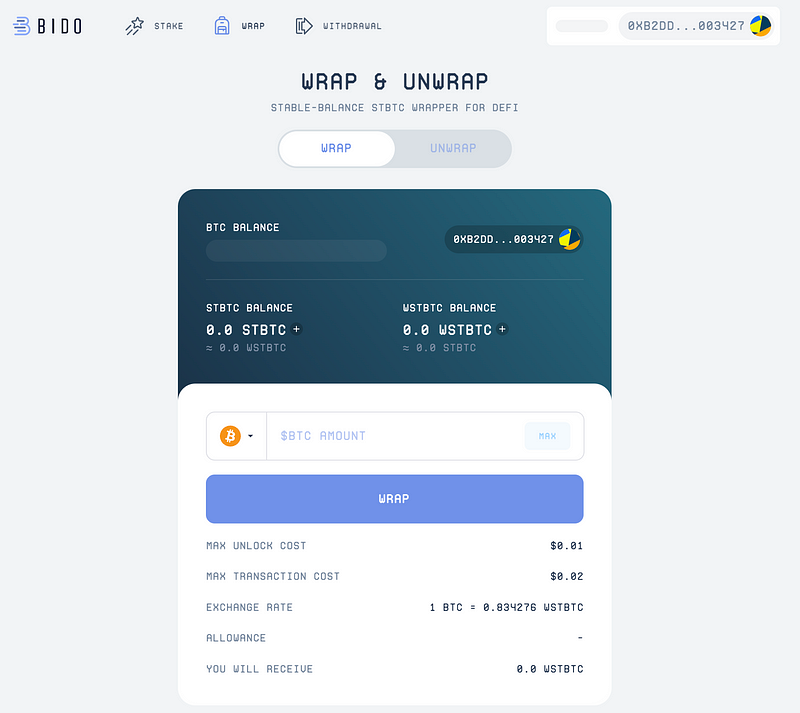

wstBTC is the wrapped and non-rebasing version of stBTC, designed to enhance its interoperability and expand its utility within the BEVM ecosystem.

wstBTC’s price denominated in stBTC changes instead. The wstBTC balance can only be changed upon transfers, minting, and burning. At any given time, anyone holding wstBTC can convert any amount of it to stBTC at a fixed rate, and vice versa. Normally, the rate gets updated once a day, when stBTC undergoes a rebase.

wstBTC enables users to participate in a wider range of DeFi applications and strategies. In Satoshi Protocol, you need to deposit wstBTC as collateral to borrow SAT.

Why this Partnership is Important

Our collaboration with Bido Finance offers several key advantages:

- Boost SAT Liquidity: Accepting wstBTC as collateral to borrow SAT will increase this stablecoin’s liquidity and utility in the ecosystem.

- Flexible DeFi Access: Leverage wstBTC for DeFi activities without selling Bitcoin.

- Higher Yields: wstBTC holders gain access to Satoshi Protocol’s offerings for amplified returns.

- BEVM Ecosystem Synergy: Collaboration fosters integration within the BEVM ecosystem.

How to Borrow SAT with wstBTC

To unlock these benefits and leverage wstBTC as collateral on Satoshi Protocol, follow these steps:

- Receive wstBTC on Bido Finance

- Bridge Your BTC: Transfer your Bitcoin (BTC) to the BEVM network using a bridge.

- Stake Your BTC: Once your BTC is on BEVM, head over to Bido Finance and stake it to receive stBTC tokens.

- Wrap Your stBTC: For expanded utility within the BEVM ecosystem, navigate to the “Wrap” tab on Bido Finance and convert your stBTC to wstBTC.

Deposit wstBTC as collateral to borrow SAT

- Step 1: Connect your wallet, navigate to the “Position” tab, and click “Create Position”

- Step 2: Input wstBTC amount and borrow SAT (at least 10 SAT)

- Step 3: Approve transaction and click “Create Position”

“We support the partnership between Satoshi Protocol and Bido as it aligns with our goal to broaden Bitcoin’s use in DeFi. This initiative leverages Satoshi’s and Bido’s technologies to enhance user benefits and innovation within our network.”

BEVM Foundation

A Shared Vision for BTCFi

Together with Bido Finance, we are committed to unlocking the full potential of BTCFi. This partnership underscores our dedication to providing innovative, secure, and beneficial solutions to Bitcoiners.

We believe that by joining forces with Bido, we can enhance the functionality and reach of our platform, making Bitcoin a more accessible and versatile asset in the DeFi sector.

About Bido Protocol

Bido is a BTC liquidity staking protocol built on the BEVM. By staking BTC, users can access yield by holding stBTC. By staking with Bido, your tokens remain liquid and can be used in a range of DeFi applications to earn additional rewards.

About Satoshi Protocol

Built on BEVM, it’s the first CDP protocol to unlock the true potential of Bitcoin. Unleash unprecedented liquidity through SAT, a stablecoin designed to supercharge the booming BTCFi market.

Website | Web APP | Twitter | Telegram | Discord | Docs | Blog