Calling all DeFi pioneers and Bitcoin Maxi !

Satoshi Protocol stands as the pioneering CDP protocol built on @BTCLayer2, poised to become the foundational infrastructure for the BTCFi ecosystem. Through BEVM, developers find it significantly more accessible to onboard and construct products in comparison to other scaling solutions.

As Ethereum developers and early Bitcoin investors, our team is driven by a desire to unlock the immense potential of this trillion-dollar market.

What is CDP ?

CDP stands for Collateralized Debt Positions, it allows you to deposit your BTC as collateral and borrow stablecoin SAT. This approach allows you to hold BTC while simultaneously accessing liquidity.

Motivation : Why CDP

When Satoshi Nakamoto designed Bitcoin, his vision was to create a peer-to-peer payment network, aiming to establish a digital payment tool for the world.

Currently, Bitcoin functions admirably as digital gold, having become a widely recognized asset, as evidenced by the approval of 11 Spot Bitcoin ETFs for trading on the different exchanges.

While Bitcoin excels as digital gold, it falls short of being an ideal currency, which should possess three key attributes: serving as a medium of exchange, a unit of account, and a store of value.

Therefore, stablecoins based on Bitcoin are a necessity.

What is BEVM ?

BEVM is a fully decentralized Bitcoin Layer 2 solution compatible with the Ethereum Virtual Machine (EVM). It uses Bitcoin as its native gas and stores transaction data on the Bitcoin mainnet, but validates transactions on Bitcoin Light Nodes.

BEVM utilizes Bitcoin light nodes on-chain that support Wasm to fetch data directly from the Bitcoin network.

Taproot upgrade provides the technical foundation for decentralization of BEVM. It breaks through the restraints of traditional Bitcoin multi-signature, Schnorr signature algorithm realizes transaction aggregation, greatly reducing transaction data volume and costs.

The combination of MAST contract framework and aggregate signature algorithm realizes threshold signature mechanism, providing Layer 2 with high programmability and extensibility.

Because BEVM is compatible with the Ethereum Virtual Machine (EVM), it supports development using Solidity and wallets such as Metamask.

This compatibility ensures a user experience that closely resembles that of Ethereum. On the BEVM ecosystem page, you can find 20+ projects currently being deployed on testnet.

To grasp BEVM’s technical implementation, visit the official blog and read < Beyond Bitcoin’s Limits: A Pioneer to Crafting the Optimal Layer 2 Solution > for insights into its architecture and functionalities.

Website | Document | BEVM Explorer

What Is Satoshi Protocol ?

Satoshi Protocol is the first CDP protocol built on BEVM, facilitating users to deposit BTC and mint the stablecoin SAT,effectively unlocking trillions of dollars in BTC’s liquidity. Our vision is to make BTCFi accessible to the public.

How does Satoshi Protocol work ?

Users deposit BTC as collateral and mint SAT with a fixed 4.5% annual interest rate. These interest revenues are distributed to the OSHI token staker.

All SAT is backed by BTC and is over-collateralized. If the collateral ratio falls below the minimal CR (MCR) of 110%, a liquidation event occurs, using the liquidity of the Stability Pool to repay the debt.

Although the MCR is 110%, to prevent liquidation, maintaining the collateral value above 150% is highly recommended!

Stability Pool ( SP )

The Stability Pool is vital for ensuring the protocol maintains ample liquidity to exchange liquidated collateral for SAT and settle debts.

By depositing SAT into the Stability Pool to become SP providers, you can capitalize on opportunities during liquidation events to acquire collateral at a discount from the current market price, incentivizing their participation.

Liquidation Mechanism

The liquidation mechanism within the Satoshi Protocol is initiated under specific conditions :

- If the value of an individual’s position’s collateral, in our case BTC, drops, causing the collateral ratio to fall below 110%.

- LP of Stability Pool can trigger the liquidation event.

- The user’s collateral is sold to the Stability Pool at a discounted price.

- In exchange for the liquidated collateral, protocol will receive SAT from the Stability Pool.

- These SAT are then utilized to repay the debt and settle the user’s position, ensuring the protocol remains solvent and stable.

This mechanism safeguards the integrity of the protocol by swiftly addressing undercollateralized positions, thereby minimizing risks and maintaining the overall health of the system.

Maintaining the $1 Peg : Satoshi Protocol’s Three Pillars

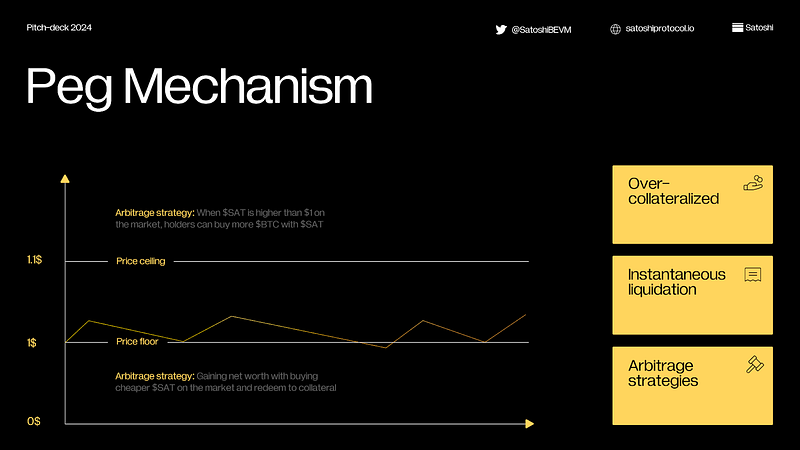

The Satoshi Protocol thrives on its stable $1 peg for SAT, achieved through a robust three-pillar system :

1. Redemption ( peg mechanism )

SAT < $1 , arbitrageurs buy SAT and redeem for $1 USD worth BTC

When $SAT trades below $1 (price floor), users can exploit arbitrage opportunities by purchasing discounted $SAT and redeeming them for $1 worth of BTC from the protocol.

This straightforward arbitrage strategy allows users to profit from the price difference.

SAT > $1.1 , arbitrageurs sell premium SAT by borrowing SAT

Conversely, when SAT rises above $1.1 (price ceiling) at any DEX, arbitrageurs can use the Satoshi Protocol to mint SAT at a 110% Collateral Ratio (CR), the Minimal CR, and sell immediately to pocket the profit. This action effectively increases the selling pressure on SAT and pushes its price back below the $1.1 level.

2. Over-collateralization

Users seeking to borrow SAT must lock-up collateral valued at 110% of their loan ( Collateral Ratio > 110% ), creating a buffer against price fluctuations.

This ensures even if the collateral dips slightly, there’s enough value to cover the debt.

3. Stability Pool

This pool serves as the system’s safety net. If a borrower’s collateral ratio falls below the 110% threshold, it will allow protocol to trigger liquidation.

The liquidated collateral is then sold at a discount to Stability Pool providers, who provide SAT into the system to repay the debt.

Reshaping the BTCFi Landscape — Are You Ready for the Journey ?

The Bitcoin universe is buzzing with potential, and Satoshi Protocol sits poised to ignite a revolution in the burgeoning realm of BTCFi.

But what exactly is it, and how can you be a part of this exciting journey ? Dive in and discover the roadmap :

Testnet Launch Campaign

This initial stage invites users to experience satoshi on testnet. Deposit BTC, mint SAT, contribute to the stability pool, and even earn a commemorative NFT as proof of your participation.

This is your chance to shape the future of BTCFi before the grand unveiling.

Social Medium Campaign

The excitement doesn’t stop there. Join the social media campaign on Galxe and connect with the @satoshiBEVM.

By following, retweeting key posts, and visiting the website, you’ll earn a special On-chain Achievement Token (OAT) — your digital badge of honor. Hold onto this OAT, as it might unlock exciting surprises in the near future…

Mainnet Launch

The culmination of intense development, the mainnet launch marks the protocol’s official debut in the BTCFi landscape.

Why Now ? The Perfect Storm for BTFi

The timing couldn’t be better. With the Bitcoin Spot ETF approval, the anticipated April halving, and a bustling DeFi infrastructure, New Bitcoin scaling solutions, the conditions are ripe for BTCFi.

Satoshi Protocol taps into a vast, untapped market potential within the Bitcoin ecosystem, waiting to be unleashed.

Are you ready to join the BTCFi revolution ?

Stay tuned for further updates and explore the Satoshi Protocol website to learn more.

Remember, this is just the beginning of an exciting journey, and you have the chance to be a part of shaping the future. Don’t miss out !

About Satoshi Protocol

Satoshi Protocol is the first CDP protocol built on BEVM, facilitating users to deposit BTC and mint stablecoin SAT, effectively unlocking trillions of dollars in BTC liquidity. Our vision is to make BTCFi accessible to the public.